ETH Price Prediction: Breaking $5K as Institutional Demand Meets Technical Breakout

#ETH

- Technical Breakout: ETH price sustains above key moving average with Bollinger Band expansion

- Institutional Adoption: Record ETF inflows and whale accumulation signal strong demand

- Macro Risks: Fed policy and network congestion may cause short-term volatility

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Near Key Resistance

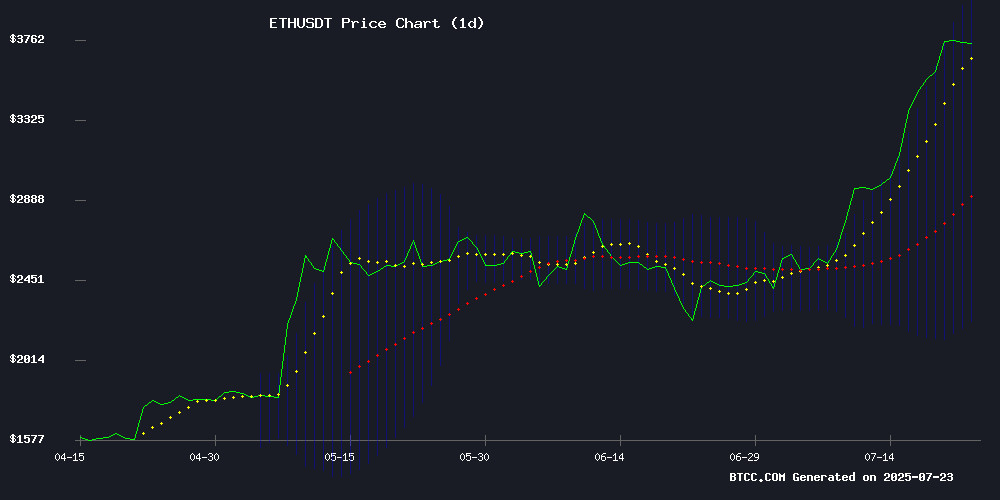

ETH is currently trading at $3,588.83, significantly above its 20-day moving average of $3,116.93, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-130.87), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band ($3,999.83), a classic sign of upward momentum. 'When ETH sustains above the 20-day MA with Bollinger Band expansion, we typically see continuation patterns,' says BTCC analyst Emma.

Institutional Demand and ETF Inflows Fuel Ethereum Rally

Spot Ether ETFs have recorded 13 consecutive days of inflows totaling $533M, while whales accumulated $685M in ETH over 24 hours. The Fed's rate decision and World Liberty Financial's expanded ethereum holdings reflect growing institutional interest. 'The $5K psychological threshold is now in play as accumulation patterns mirror early 2021 bull market behavior,' notes BTCC's Emma. However, network congestion from validator queues and global macro uncertainty present near-term risks.

Factors Influencing ETH's Price

Spot Ether ETFs Extend Inflow Streak to 13 Sessions with $533 Million

Spot Ether ETFs have recorded another robust day of inflows, adding $533.87 million on Tuesday. This marks the 13th consecutive trading day of net inflows, pushing the cumulative total beyond $4 billion. The sustained demand underscores growing institutional confidence in Ethereum-based investment products.

BlackRock's iShares Ethereum Trust dominated the flows, absorbing $426.22 million alone—a move that propelled its total assets above $10 billion. Fidelity's FETH followed with a respectable $35 million inflow, while other funds contributed an additional $72.65 million. The collective assets under management across all Spot Ether ETFs now stand at $19.85 billion, representing 4.44% of Ethereum's total market capitalization.

Since July 2, these products have seen their cumulative inflows more than double from $4.25 billion to $8.32 billion. The unbroken streak of positive flows coincides with improving macro conditions for risk assets and deepening institutional participation in crypto markets.

Five New Crypto Wallets Accumulate $285M in ETH From Kraken in Single Day

Five newly created cryptocurrency wallets have withdrawn 76,987 ETH (worth approximately $285 million) from Kraken in a single day, signaling potential institutional accumulation. On-chain analytics platform Lookonchain identified the transactions, noting three additional fresh wallets moved 10,703 ETH ($39.6 million) from the same exchange.

The pseudonymous nature of blockchain transactions obscures ownership, but the scale suggests sophisticated players. Such off-exchange movements typically indicate supply reduction rather than imminent selling pressure—a bullish signal for Ethereum’s market dynamics.

This follows a broader trend of large-scale ETH accumulation observed in recent months. Analysts interpret these withdrawals as a vote of confidence in Ethereum’s long-term value proposition, reinforcing its position as institutional-grade digital infrastructure.

Ethereum Whale Accumulates $400M in ETH as Market Eyes $5K Threshold

Ethereum's price surged 62% over the past month, fueled by regulatory tailwinds from the U.S. Genius and Clarity Acts and anticipation surrounding the Pectra upgrade. The rally coincides with a new whale address accumulating $397 million worth of ETH in just four days, signaling institutional confidence in further upside.

Analyst Ted Pillows highlighted the whale activity via on-chain data, noting a single $125 million purchase as ETH approached $4,000. The Pectra upgrade's fee-stabilizing mechanisms—including increased blob capacity and EVM transaction batching—have maintained network fees between $0.50-$2 despite price volatility.

Market sentiment now pivots on whether ETH can breach its all-time high. The combination of whale accumulation, scalable infrastructure improvements, and favorable macro conditions creates a plausible path to $5,000.

Fed’s Interest Rate Decision and Crypto Market Dynamics: Key Insights

The Federal Reserve's impending interest rate decision on August 1st is poised to ripple through global markets, with cryptocurrencies bracing for heightened volatility. Analysts anticipate rates to remain steady, but the simultaneous activation of postponed tariffs—initially set by the Trump administration—could amplify inflationary pressures. Ethereum, trading at $3,610, remains a focal point, with Michael van de Poppe's updated projections signaling potential short-term momentum for altcoins.

Market participants are eyeing the Fed's commentary for clues on monetary policy trajectory, particularly after recent inflation data. The tariff implementation, affecting over 150 countries without EU consensus, may further strain economic conditions. Crypto traders are pivoting toward platforms offering agility in this uncertain climate, as liquidity and volatility expectations rise.

World Liberty Financial Expands Ethereum Holdings Amid Institutional Demand

World Liberty Financial has bolstered its Ethereum portfolio with a $13 million purchase of 3,473 ETH, executed at an average price of $3,743 per token. The acquisition elevates the firm's total ETH holdings to 73,616, now valued at approximately $275 million. This strategic accumulation reflects growing institutional interest in Ethereum as a core crypto asset.

The platform's average acquisition cost stands at $3,272 per ETH, yielding an unrealized profit exceeding $33 million. Recent weeks have seen consistent buying activity, including a $10 million purchase of 3,007 ETH last week and a $3.5 million acquisition in May. Ethereum's price surge of 20% weekly and 67% monthly underscores the timing of these investments.

Market momentum continues to favor Ethereum, with prices reaching $3,763 amid broader crypto market recovery. Institutional players are increasingly viewing ETH as a strategic holding, with World Liberty Financial's aggressive accumulation serving as a bellwether for professional investment trends in digital assets.

ETHSofia 2025 Conference to Spotlight Web3 Security with Industry Leaders

ETHSofia 2025, the flagship Ethereum event in the Balkan region, will convene September 24-25 at Sofia Tech Park. This year's agenda zeroes in on Web3 security—a timely focus amid rising exploits in decentralized protocols. Ledger's Nicolas Bacca, Consensys' Stefan Bratanov, and Centrifuge's Martin Quensel headline a roster of speakers from top-tier projects.

The three-day program features deep dives into smart contract vulnerabilities, infrastructure hardening, and exploit mitigation. Workshops will pair theoretical frameworks with hands-on red teaming exercises—an acknowledgment that blockchain's promise hinges on adversarial resilience.

RedStone's Mike Massari and Pashov Audit Group founder Krum Pashov will dissect recent DeFi breaches, while Token Economy author Shermin Voshmgir addresses systemic trust architectures. Secondary tracks explore AI-auditing tools and cross-chain security paradigms.

Crypto Markets Dip Amid Global Uncertainty and Trump's Tariff Threats

Cryptocurrency markets are experiencing a pullback after days of steady gains, with Ethereum (ETH) dropping below $3,600. The decline appears linked to broader economic uncertainty, particularly surrounding former President Donald Trump's recent tariff remarks.

Trump's statement that nations must open markets or face higher tariffs has rattled investors. While some Asian countries have complied, resistance from the EU and others creates potential trade friction. This comes as markets brace for next week's Federal Reserve interest rate decision and August 1 tariff implementations.

The crypto market's resilience during previous geopolitical tensions appears to be wavering as concrete economic risks emerge. ETH's price action suggests traders are taking defensive positions ahead of potential volatility.

Ozzy Osbourne’s Death Triggers 650% Surge in CryptoBatz NFT Prices

The passing of rock legend Ozzy Osbourne at 76 has ignited a frenzy in the NFT market, specifically for his CryptoBatz collection. Demand for these digital assets skyrocketed within hours, with prices surging over 650% on OpenSea—from below 0.02 ETH to 0.15 ETH ($548).

Launched in December 2021, the 9,666-piece collection saw trading volume explode by 100,000% to $281,200 within a day, capturing nearly 80% of its total historical value. The Megadragon bat now commands 99 ETH, while the floor price stabilizes at $36.80. Though activity remains below January 2022’s peak of 5 ETH per NFT, traders interpret the rally as a potential market reawakening.

Ethereum Validators Flood Network Queues Amid Price Rally

Ethereum's validator queues swelled to record levels as ETH's 162% price surge since April triggered simultaneous waves of profit-taking and fresh institutional interest. Blockchain data shows 521,000 ETH ($1.9 billion) awaiting withdrawal—the largest exit queue since 2024—with wait times stretching to nine days.

The entry queue tells a parallel story of growing mainstream adoption. Over 359,500 ETH ($1.3 billion) awaits activation, fueled by BlackRock's staking language adoption and corporate treasury moves from firms like SharpLink Gaming. This institutional momentum follows May's regulatory clarity when the SEC declined to classify staking as a securities offering.

Ethereum Price Prediction: Institutional Demand Fuels Rally as ETH Nears Key Resistance

Ethereum surged 26% in one week to hit $3,848, its highest level since 2025, as institutional adoption accelerates. The rally comes amid record ETF inflows and growing corporate treasury allocations, though ETH remains 22% below its all-time high of $4,878.

American investors poured $726 million into ETH exchange-traded funds in a single day, forcing issuers to scramble for inventory. Open interest surpassed $56 billion as traders positioned aggressively for further upside.

Meanwhile, Remittix's $16.8 million presale highlights shifting investor appetite toward payment-focused tokens. The PayFi solution bridges crypto to fiat transfers across 30 countries, contrasting with purely speculative assets.

AIXA Miner Offers Regulated Passive Income Through Cloud Mining in 2025

Cryptocurrency investors in 2025 are increasingly favoring predictable revenue streams over volatile trading. AIXA Miner emerges as a solution, providing automated, AI-assisted cloud mining with institutional-grade security and compliance.

The platform's short-term mining contracts allow users to earn daily returns without risking principal. A notable example is the 6-day ETH mining plan requiring a $1,200 deposit, yielding approximately $18.25 daily for a total return exceeding $1,309.

This approach reflects broader market trends toward regulated, non-speculative crypto income generation. AIXA Miner's model appeals particularly to ETH holders seeking stable returns amid market fluctuations.

Is ETH a good investment?

ETH presents a compelling investment case based on these factors:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | +15.1% | Strong uptrend |

| MACD Histogram | -130.87 | Bearish momentum fading |

| Bollinger Position | Upper Band | Overbought but bullish |

| ETF Inflows | $533M (13 days) | Sustained institutional demand |

BTCC's Emma advises: 'While short-term volatility may occur near $4K resistance, the confluence of technical breakout and institutional flows suggests ETH could test $5K by Q3 2025. Dollar-cost averaging remains prudent.'

1